In What Ways Can Market Sentiment And Investor Psychology Impact The Volatility Of Safe Haven Assets?

Introduction

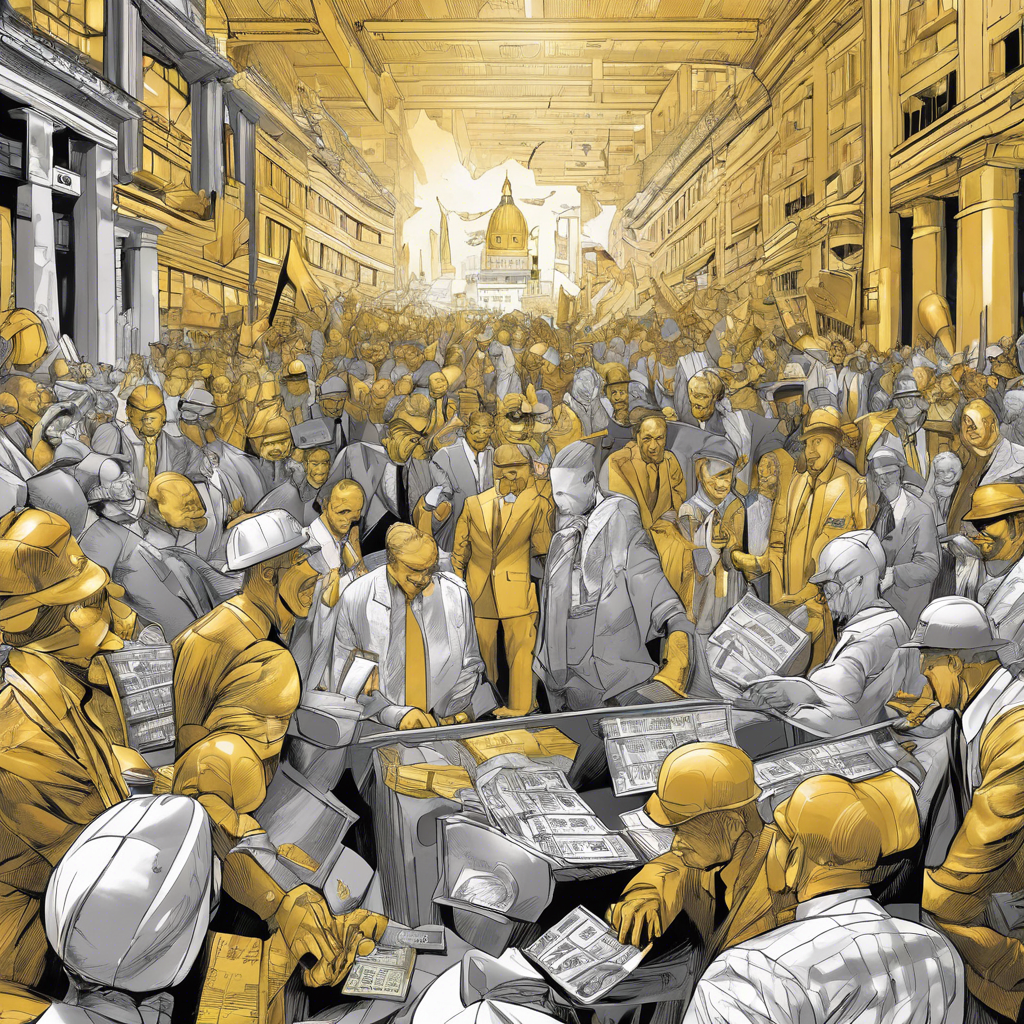

Market sentiment and investor psychology are critical elements influencing the volatility of safe haven assets like gold, silver, and government bonds. Grasping these psychological factors is essential for understanding how these assets react to market fluctuations and economic uncertainties, particularly during times of financial crisis or market instability.

Impact of Market Sentiment on Safe Haven Assets

Market sentiment encapsulates the overall mood and attitudes of investors, heavily influenced by news reports, global events, and key economic indicators. During periods of negative market sentiment, driven by geopolitical tensions or severe economic downturns, investors tend to seek refuge in safe haven assets as a protective strategy. This collective investor behavior often results in substantial price fluctuations and increased volatility in these safe havens. A prime example is the surge in gold demand during the 2008 financial crisis, as investors prioritized security, leading to a rapid increase in gold prices. Conversely, as optimism regarding economic recovery rises, demand for safe haven assets typically declines, resulting in price corrections as investors reassess their portfolios.

- In times of economic instability, increased investor demand for safe havens results in substantial price surges and amplified volatility.

- When positive sentiment about economic recovery prevails, interest in safe haven assets often diminishes, leading to price declines.

Influence of Investor Psychology

Investor psychology involves the emotional and cognitive factors that influence financial decision-making. Fear and panic can drive an increased rush toward safe haven assets, while unwarranted confidence in economic recovery can lead to a sell-off of these assets. This cyclical relationship between emotions and investment behaviors significantly contributes to market volatility, with asset prices fluctuating dramatically based on prevailing sentiments rather than their true value. For example, during uncertain times, the instinctive fear of losing capital may overshadow the potential for gains, prompting investors to favor safety over riskier investments. Additionally, cognitive biases such as herding behavior can further amplify price changes associated with these psychological influences.

- Fear-driven buying behaviors can lead to significant price spikes and increased volatility in safe haven assets.

- Confidence in overall economic recovery can trigger sell-offs of safe haven assets, resulting in notable price declines.

Conclusion

In conclusion, the volatility exhibited by safe haven assets is deeply intertwined with market sentiment and the psychology of investors. These elements demonstrate that market fluctuations are not solely dictated by economic fundamentals but are significantly influenced by collective behaviors and investor emotions. Recognizing this relationship can provide critical insights for investors navigating turbulent markets and facilitate more effective risk management strategies.

Expert Quote

Dr. John B. Taylor, Professor of Economics at Stanford University

Market volatility is often intensified by fluctuations in investor sentiment; when fear prevails, there is a notable influx of capital into safe havens, driving both their prices and volatility higher.

Book: 'Principles of Economics', Wiley, 2018

Relevant Links

The impact of regulation on cryptocurrency market volatility in the ...

https://www.sciencedirect.com/science/article/abs/pii/S031359262300200XDo volatility indices diminish gold's appeal as a safe haven to ...

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8463038/What Are Safe Haven Assets and How Do You Trade Them? | IG ...

https://www.ig.com/en/trading-strategies/what-are-safe-haven-assets-and-how-do-you-trade-them--181031Dynamic sentiment spillovers among crude oil, gold, and Bitcoin ...

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7714240/Fear and Greed Index - Investor Sentiment | CNN

https://www.cnn.com/markets/fear-and-greedYouTube Videos

Most popular questions

How Do The Personal Relationships Among Gods Affect Their Decisions In The Iliad?

The intricate relationships among the gods in Homer's epic poem 'The Iliad' play a crucial role in shaping their actions and decisions. These divine interactions create a complex web of fates, where each god's personal alliances and rivalries directly influence the events of the mortal world.

What Strategies Can Parents Use To Educate Their Children About Online Safety Beyond Privacy Settings?

In today's digital landscape, teaching children about online safety is essential for their protection and well-being. While privacy settings play a critical role, parents can implement various strategies to create a thorough understanding of online safety principles among their children.

What Are The Different Types Of Insulation Materials Commonly Used In Buildings, And How Do They Compare In Terms Of Thermal Resistance?

Insulation materials are vital for enhancing energy efficiency in residential and commercial buildings by minimizing heat transfer. Understanding the various insulation types can lead to better choices for thermal resistance and overall comfort.

Most recent questions

How Does User-generated Content Influence Purchasing Decisions Among Millennials?

User-generated content, often abbreviated as UGC, is essential in influencing purchasing decisions, especially among Millennials who prioritize authenticity and relatability in their shopping experiences.

How Do Cultural Differences Influence Personal Space Preferences In Both Indoor And Outdoor Social Events?

Understanding personal space preferences is essential as they are greatly influenced by cultural backgrounds. These space preferences can significantly impact social interactions in various settings, both indoors and outdoors, making cultural awareness vital for effective communication.

How Do Budget Allocations For Voice Acting And Writing Compare In Their Influence On Game Character Development?

In the competitive world of video games, character development is essential for creating engaging and immersive player experiences. Two critical elements that significantly influence this development are voice acting and writing. By exploring how budget allocations for writing and voice acting impact character creation, we can better understand their roles in enhancing gameplay and player satisfaction.